Is It Still Worth Investing In Bitcoin In 2019? Here's What Experts Have To Say

Hailed as one of the world's most volatile and riskiest assets to invest in, Bitcoin is unquestionably one of the most talked about revolutions in financial technology. The cryptocurrency, which was created in 2009, has taken the world by storm.

But amongst all the hype and drama, many individuals are questioning whether this form of digital cash is worth investing in.

In this article, we're going to dive into whether Bitcoin is still a viable investment option, and what the experts around the globe are saying about the bellwether of the cryptocurrency markets.

Bitcoin: A Brief History

Bitcoin, founded in 2009 by anonymous cryptographer Satoshi Nakamoto, has become known as one of the world’s most revolutionary financial technologies, with many computer programmers and developers now working together to create thousands of alternatives to the flagship cryptocurrency.

Bitcoin is underpinned by blockchain technology - in basic terms, blockchains are distributed ledgers that allow people to securely transact digital assets such as bitcoin, without the need for a third-party such as a bank.

But amongst all the hype and drama, many individuals are questioning whether this form of digital cash is worth investing in.

In this article, we're going to dive into whether Bitcoin is still a viable investment option, and what the experts around the globe are saying about the bellwether of the cryptocurrency markets.

Bitcoin: A Brief History

Bitcoin, founded in 2009 by anonymous cryptographer Satoshi Nakamoto, has become known as one of the world’s most revolutionary financial technologies, with many computer programmers and developers now working together to create thousands of alternatives to the flagship cryptocurrency.

Bitcoin is underpinned by blockchain technology - in basic terms, blockchains are distributed ledgers that allow people to securely transact digital assets such as bitcoin, without the need for a third-party such as a bank.

Since its birth, bitcoin has accumulated a wealth of attention from millions of people, both for the right and wrong reasons. The value of the cryptocurrency’s value has witnessed incredible volatility - a $1000 investment in bitcoin 10 years ago would now be worth over US$2 billion.

However, after reaching an all-time high of nearly $20,000 in December 2017, bitcoin has faced a devastating decline, eventually reaching a low of nearly $3000 one year later. This disastrous fall in price has left many speculators questioning whether it’s still worth investing in the so-called kingpin of digital currencies.

The Current State Of Bitcoin

Bitcoin has been consistently trading above its 13-day and 26-day moving average (marked by the blue and yellow lines respectively) since February of this year, which is a positive sign, suggesting that market traders believe bitcoin is likely to continue its rise in value.

(Source: finance.yahoo.com)

The price of bitcoin current stands at around $8500, up nearly 170% since its low in late 2018. On the 30th May 2019, price action saw BTC pierce the $9000 level, reaching a yearly high of $9065. With the recent spike in bitcoin prices, many are left wondering whether the flagship cryptocurrency is still a worthwhile investment.

But what is moving the price of bitcoin? Many cryptocurrency enthusiasts are making correlations between the rise in bitcoin and other cryptocurrency prices with the increase in global uncertainty. Beginning in October, the Dow Jones Industrial Average (DJIA) saw catastrophic losses, fueled by many negative economic indicators, such as flattening treasury bond yield curves. The DJIA finally sunk to a yearly low in December, which coincidentally saw Bitcoin spring back into action, which is why many speculators are suggesting that Bitcoin is being used as a hedge against global economic uncertainty.

Other factors may be contributing to the sudden spike in cryptocurrency prices. Announcements have been made that global investment firm Fidelity may soon be offering cryptocurrency investment tools for its institutional clientele. Institutional investors are tipped to play a huge role in the rise of bitcoin prices, with additional institutional dollars being poured into the crypto markets providing a much-needed boost to overall market liquidity.

Still An Investment Opportunity?

After declining over 80% in value in a single twelve month period, the price of bitcoin has begun a steady incline. Here on the chart below, we've pointed out a few patterns that could suggest bitcoin's decline has reached its end stage and may continue to rise in value over the coming months and years:

(source: finance.yahoo.com)

The chart above shows how bitcoin had reached a significant low, piercing the ‘oversold’ region on the Relative Strength Index (RSI).

The RSI is a technical indicator which states whether a tradable asset, such as a stock or in this case, bitcoin, is ‘overbought’ (meaning too many people have purchased the asset above its relative value) or ‘oversold’ (where the asset has been sold too many times, and not enough people buying it).

With bitcoin’s price going into the oversold region, it suggests that the asset may be undervalued, meaning that it may be a good time to purchase. Since this instance, the price of bitcoin has steadily inclined, recently staging a price rally back above $9000 - a figure that hasn’t been seen since May 2018.

But will the value of the bitcoin continue to rise? Here’s what some experts have to say on the matter.

What Experts Have To Say

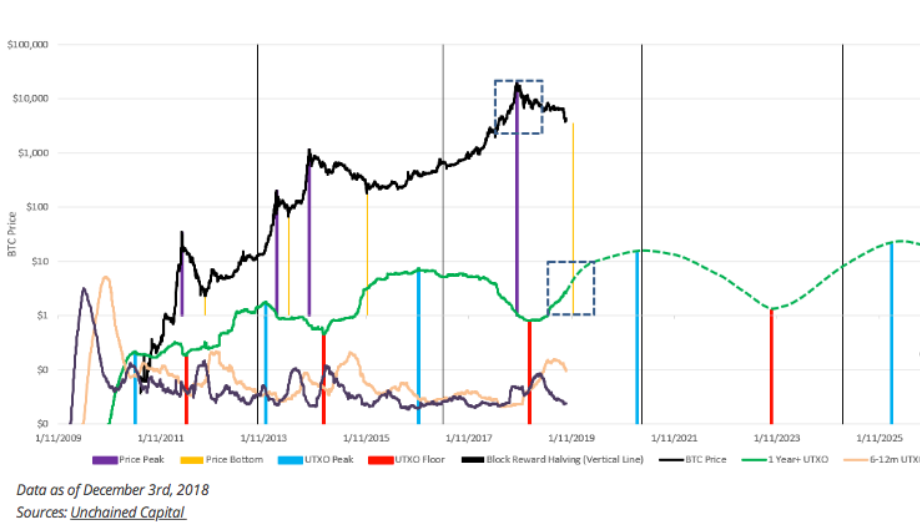

Analysts at market research firm Delphi Digital have used past data to predict the future course for bitcoin. The research they conducted shows that the price of bitcoin would demonstrate a rebound in the first quarter of 2019 (marked by blue dashed square encompassing the green line) - something that has so far proved to be the case.

One of the world’s most famous proponents of bitcoin, Anthony “Pomp” Pompliano, was recently interviewed on CNBC’s "Squawk Box" to discuss the future of Bitcoin. Pompliano, who is also the founder of Morgan Creek Digital Assets, states in the interview - "it wouldn't surprise me if we enter kind of a two to three-year bull market now, and $20,000 will be a blip on the radar."

Although many are optimistic about the future of Bitcoin and crypto as a whole, a few leaders in the financial world aren't so sure. Earlier this month, Mario Draghi, the president of the European Central Bank (ECB) suggested that cryptocurrencies as a whole are extremely risky assets to invest in. In a statement, Draghi said:

“Cryptocurrencies or bitcoins, or anything like that, are not really currencies — they are assets. A euro is a euro — today, tomorrow, in a month — it’s always a euro. And the ECB is behind the euro. Who is behind the cryptocurrencies? So they are very, very risky assets.”

In a recent report, the ECB suggested that the value of crypto assets such as bitcoin may be vulnerable due to the absence of an intermediary, such as a central bank, which will hinder the use of digital currencies as money. In the report, the ECB stated that volatility displayed by cryptocurrency prices “a) prevents their use as a store of value; b) discourages their use as a means of payment; and c) makes it difficult to use them as a unit of account.”

Crypto pioneer, and founder of crypto investment firm Galaxy Digital, Mike Novogratz, recently stated his predictions for Bitcoin in the near future. According to Bloomberg, in a conference call discussing his firm’s quarterly earnings, the Galaxy Digital CEO said:

“On a go-forward basis, Bitcoin probably consolidates somewhere between $7,000 and $10,000.”

This seems to be a relatively sensible price prediction for the near-term, considering bitcoin has been seeing huge bullish momentum over the last few weeks.

Time To Invest? Remember To Do Your Research

There is a myriad of speculative stances on the future of bitcoin and digital currencies in general. Although many cryptocurrency enthusiasts are optimistic about the long-term future of bitcoin, many government officials and economists are extremely sceptical.

When it comes to investing in highly volatile assets such as bitcoin, it’s always best to make sure you fully understand the risks involved. Make sure to complete your own thorough research before making any investment decisions.

If you’re new to bitcoin, it’s best to read up on the bitcoin whitepaper so you can grasp a full understanding of the cryptocurrency and the underlying technology that supports it.

user rating :

5.00 stars (5 votes)

Lewis is a U.K. Based writer, with a huge passion for music, travel, health, fitness, finance, and self-development. He truly believes that the pen is mightier than the sword and wants to utilize his passion for writing to help empower people with information that could help them greatly improve their lives and the world around them.