Best MONEY-SAVING APPS – Earn money while spending money

Managing money can be a real pain for some of us. Not only that we need to balance our income and expenses, but if you add, credit cards, student loans, or mortgages, and sprinkle in some immediate spending goals, things begin to feel more stressful than they should. Taking everything into consideration, sticking to a budget or even thinking about what you can do with your hard earned cash, is never easy if you are the kind of person that values their time and effort.

And if you are not, well you should be. Because on your way to improvement and success you will encounter many obstacles, but few will be more detrimental than the wrong financial decisions. Any man should know how to improve this area, especially when it comes to being responsible and making the right decisions regarding all things having to do with money.

Remember that taking care of your money means getting the best out of your work and improving faster and with more success. And that in itself should be a goal for every iconic man.

This is exactly where money-saving apps come in. They help you keep track of everything you spend, manage your budget and make money for you, by saving you from having to guess your way around your finances.

But not every mobile money management tool is worth downloading. So what are the best money-saving apps and how can they help you, your spending habits, or your business investments?

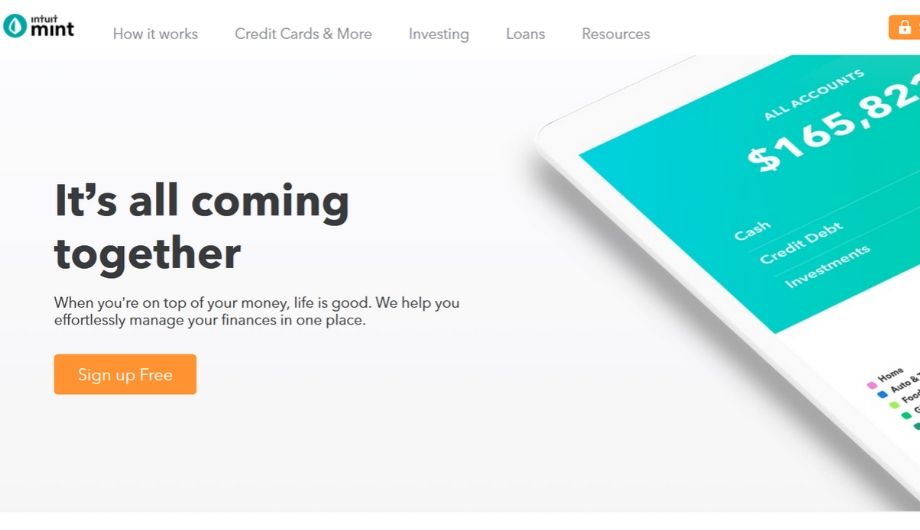

If you are on the look out for a great all-round money-saving app, that can simplify your control over the most important aspects of your finances, then you should look no further than Mint.

This App brings together pretty much everything you would expect after you install it, and it does it with superb efficiency.

Mint lets you know when your bills are due, the amount of money you have, and how much can you afford to pay. And it does much more than that. Like a practical little AI, Mint registers your habits and sends you advice on how to gain even more control over your finances. It analyzes thousands of data entries, savings, credit card payments, brokerage, CD and IRA rollover offers—then makes recommendations that could help save you money based on your lifestyle and goals.

The app can also send you payment reminders, or warn you if you're approaching budget limits. Mint will bring together your financial life, all the way down to a free credit score report summary and a portfolio tracking feature.

Mint allows you to easily separate out purchases from the same transaction into different categories. So it does not matter if you buy groceries, clothing, and gifts all at one store. Your trusty financial monitor will keep track of and allow every individual purchase to go to the right category.

A smart, easy to use way to connect all your bank and credit card accounts, as well as all your monthly bills, in one convenient place.

You may remember this app as the original round-up app. It was launched in 2014 with a mission to invest your spare change. And as such pioneered many of the things we now take for granted when it comes to money-saving apps. Acorn rounds up each card purchase to the nearest dollar, investing extra pennies in a diversified portfolio of low-cost index ETFs.

Acorns “Found Money” program is partnered up with more than 200 brands to kick in a percentage of purchases to a buyer’s Acorns accounts.

The company's latest product line is “Grow,” a financial advising platform aimed at educating its users on topics like budgeting, debt and saving among other topics.

In many ways, Acorns is closer to Revolut than to Mint, as it offers you the possibility of obtaining a proprietary visa debit card that allows you to access Acorns Spend. The only checking account with a debit card that saves, earns and invests for you.

Acorn is totally protected having an FDIC-insured checking account all the way to $250,000 plus fraud protection and an all-digital card lock.

If you haven’t tried Acorns before, this is the best time to do so. It is a very coherent money-saving tool that will not only help you keep track of your investment but actually help you make them. Add to that the fact that it will help you organize your spending and save you from banking fees, and you will see why this veteran app is still going strong.

It is not a free app, as it has three payment plans that cost between 1 and 3 dollars a month. The one you want is the latter, as it helps you check your spending and guide you into earning more with up to 10% bonus investments and allows you to invest automatically with built-in investment and retirement accounts.

This app is one of the most fun ways you can keep your expenses in check while making sure the money you save pile up to best serve your goals.

And the reason for that is that it is a set and forget app. If you are a person that already keeps a careful eye on spending you will appreciate this app even more. Because Digit can connect to an existing bank account and make small transactions towards a savings goal. But you can get that with Acorns as well. So what makes this app so distinct? Well, while Acorns requires users to specify certain criteria before transferring the money, Digit uses a special algorithm that analyzes your spending habits.

It also factors in the amount of money in your accounts, and transaction times and calculates a unique number to set aside. This custom form of saving frees your time, so you can focus on actually making money, instead of calculating what amount will help you the most. It very important for people that have a fluctuating income. Deposits towards your savings goal will happen continually throughout the month, but will only happen when the system detects that you can afford it. Share what you're saving for and Digit does the rest. It can budget for your next vacation, pay off credit cards, or put money away for a rainy day. And you can set as many goals as you like.

This fun and carefree way of saving money will come at a cost. Subscription is $2.99 a month but it is worth it.

Digit is a set and forget app for saving money. And is ideal for those that often get stressed about bank account management. Imagine having an app that analyzes your spending and automatically saves the perfect amount every day, so you don't have to think about it. Now imagine no more and download Digit. It will change the way you save money.

This is one of the best expense tracking apps out there. And you should use it because the most important part of making money is to always keep track of your expenses.

What made us recommend this app is the fact that, unlike the shoebox where you keep your receipts before sending them to your accountant or for tax returns, this app is all about convenience. It will allow you to take a photo of a paper receipt and automatically extract all of the expenses, payment method, date, location information, and save it digitally.

Extracted data is fully searchable and editable. The extracted information will be double checked and verified. Shoeboxed ensures that all of your receipts are legibly scanned, clearly categorized, and easy to locate. And above all that they are accepted by the Internal Revenue Service (IRS) both in the US and Canada.

If you haven’t tried something like this before you will be amazed at how much time this app will save you and it will alleviate many problems. Shoeboxed will help you match those elusive expenses with a date or an item, thus providing you with the comfort that your purchases will not come back to haunt you.

This app is the best financial stress reliever you can find and one of the easiest ways know to man to convert paper trails, into digital heaven.

The start-up subscription plan will cost you $29 if you are content with 50 digital converted documents a month. And goes all the way up to $89 for the Business package, with 300 conversions, covering all your financial digital needs.

If you want to manage your money the right way and make sure you increase your savings, there are few things more important than keeping track of the payments you need to receive. And this is where this app steps in. Like any great business idea, Tycoon offers a solution to a common problem. The problem is that for people like freelancers keeping track of multiple projects is pretty difficult, especially since they're usually in the middle of one when another comes in.

Not remembering who has to pay you and when can therefore become one of your greatest enemies.

Using this app proves to be just the right thing for people who want to balance their day job and side jobs, or get their income from liberal professions. In fact, Tycoon can help any self-employed man as it is your personal digital balance sheet. This app allows you to input in all the details of your job, and keep track of payments that have come in, are scheduled to come in, or are past due.

Tycoon is the brainchild of supermodel Jess Perez. So it was designed from the beginning to organize all the gigs and side jobs you will ever have.

To put things into perspective this app will help you calculate the exact amount of money you will get to keep after taxes and commission.

That way you will know if a job is worth taking or not.

For intrepid men that like to turn most of their time into money, this is more than a valuable asset. It is an investment that will bring the best short and long term returns.

Money-saving apps can not only help you become more organized when it comes to your finances but also provide you with real gains. They teach you all you need to know about al things financially sound and help you make a bit of money on the side.

They will not only help you make money but stopping you spending too much but also come with investment tips, help you manage your investments or simply invest for you.

They will not make you a rich man but they will teach you the discipline and control you need to become one.

And if you are not, well you should be. Because on your way to improvement and success you will encounter many obstacles, but few will be more detrimental than the wrong financial decisions. Any man should know how to improve this area, especially when it comes to being responsible and making the right decisions regarding all things having to do with money.

Remember that taking care of your money means getting the best out of your work and improving faster and with more success. And that in itself should be a goal for every iconic man.

This is exactly where money-saving apps come in. They help you keep track of everything you spend, manage your budget and make money for you, by saving you from having to guess your way around your finances.

But not every mobile money management tool is worth downloading. So what are the best money-saving apps and how can they help you, your spending habits, or your business investments?

Mint

If you are on the look out for a great all-round money-saving app, that can simplify your control over the most important aspects of your finances, then you should look no further than Mint.

This App brings together pretty much everything you would expect after you install it, and it does it with superb efficiency.

Mint lets you know when your bills are due, the amount of money you have, and how much can you afford to pay. And it does much more than that. Like a practical little AI, Mint registers your habits and sends you advice on how to gain even more control over your finances. It analyzes thousands of data entries, savings, credit card payments, brokerage, CD and IRA rollover offers—then makes recommendations that could help save you money based on your lifestyle and goals.

The app can also send you payment reminders, or warn you if you're approaching budget limits. Mint will bring together your financial life, all the way down to a free credit score report summary and a portfolio tracking feature.

Mint allows you to easily separate out purchases from the same transaction into different categories. So it does not matter if you buy groceries, clothing, and gifts all at one store. Your trusty financial monitor will keep track of and allow every individual purchase to go to the right category.

A smart, easy to use way to connect all your bank and credit card accounts, as well as all your monthly bills, in one convenient place.

Acorns

You may remember this app as the original round-up app. It was launched in 2014 with a mission to invest your spare change. And as such pioneered many of the things we now take for granted when it comes to money-saving apps. Acorn rounds up each card purchase to the nearest dollar, investing extra pennies in a diversified portfolio of low-cost index ETFs.

Acorns “Found Money” program is partnered up with more than 200 brands to kick in a percentage of purchases to a buyer’s Acorns accounts.

The company's latest product line is “Grow,” a financial advising platform aimed at educating its users on topics like budgeting, debt and saving among other topics.

In many ways, Acorns is closer to Revolut than to Mint, as it offers you the possibility of obtaining a proprietary visa debit card that allows you to access Acorns Spend. The only checking account with a debit card that saves, earns and invests for you.

Acorn is totally protected having an FDIC-insured checking account all the way to $250,000 plus fraud protection and an all-digital card lock.

If you haven’t tried Acorns before, this is the best time to do so. It is a very coherent money-saving tool that will not only help you keep track of your investment but actually help you make them. Add to that the fact that it will help you organize your spending and save you from banking fees, and you will see why this veteran app is still going strong.

It is not a free app, as it has three payment plans that cost between 1 and 3 dollars a month. The one you want is the latter, as it helps you check your spending and guide you into earning more with up to 10% bonus investments and allows you to invest automatically with built-in investment and retirement accounts.

Digit

This app is one of the most fun ways you can keep your expenses in check while making sure the money you save pile up to best serve your goals.

And the reason for that is that it is a set and forget app. If you are a person that already keeps a careful eye on spending you will appreciate this app even more. Because Digit can connect to an existing bank account and make small transactions towards a savings goal. But you can get that with Acorns as well. So what makes this app so distinct? Well, while Acorns requires users to specify certain criteria before transferring the money, Digit uses a special algorithm that analyzes your spending habits.

It also factors in the amount of money in your accounts, and transaction times and calculates a unique number to set aside. This custom form of saving frees your time, so you can focus on actually making money, instead of calculating what amount will help you the most. It very important for people that have a fluctuating income. Deposits towards your savings goal will happen continually throughout the month, but will only happen when the system detects that you can afford it. Share what you're saving for and Digit does the rest. It can budget for your next vacation, pay off credit cards, or put money away for a rainy day. And you can set as many goals as you like.

This fun and carefree way of saving money will come at a cost. Subscription is $2.99 a month but it is worth it.

Digit is a set and forget app for saving money. And is ideal for those that often get stressed about bank account management. Imagine having an app that analyzes your spending and automatically saves the perfect amount every day, so you don't have to think about it. Now imagine no more and download Digit. It will change the way you save money.

Shoeboxed

This is one of the best expense tracking apps out there. And you should use it because the most important part of making money is to always keep track of your expenses.

What made us recommend this app is the fact that, unlike the shoebox where you keep your receipts before sending them to your accountant or for tax returns, this app is all about convenience. It will allow you to take a photo of a paper receipt and automatically extract all of the expenses, payment method, date, location information, and save it digitally.

Extracted data is fully searchable and editable. The extracted information will be double checked and verified. Shoeboxed ensures that all of your receipts are legibly scanned, clearly categorized, and easy to locate. And above all that they are accepted by the Internal Revenue Service (IRS) both in the US and Canada.

If you haven’t tried something like this before you will be amazed at how much time this app will save you and it will alleviate many problems. Shoeboxed will help you match those elusive expenses with a date or an item, thus providing you with the comfort that your purchases will not come back to haunt you.

This app is the best financial stress reliever you can find and one of the easiest ways know to man to convert paper trails, into digital heaven.

The start-up subscription plan will cost you $29 if you are content with 50 digital converted documents a month. And goes all the way up to $89 for the Business package, with 300 conversions, covering all your financial digital needs.

Tycoon

If you want to manage your money the right way and make sure you increase your savings, there are few things more important than keeping track of the payments you need to receive. And this is where this app steps in. Like any great business idea, Tycoon offers a solution to a common problem. The problem is that for people like freelancers keeping track of multiple projects is pretty difficult, especially since they're usually in the middle of one when another comes in.

Not remembering who has to pay you and when can therefore become one of your greatest enemies.

Using this app proves to be just the right thing for people who want to balance their day job and side jobs, or get their income from liberal professions. In fact, Tycoon can help any self-employed man as it is your personal digital balance sheet. This app allows you to input in all the details of your job, and keep track of payments that have come in, are scheduled to come in, or are past due.

Tycoon is the brainchild of supermodel Jess Perez. So it was designed from the beginning to organize all the gigs and side jobs you will ever have.

To put things into perspective this app will help you calculate the exact amount of money you will get to keep after taxes and commission.

That way you will know if a job is worth taking or not.

For intrepid men that like to turn most of their time into money, this is more than a valuable asset. It is an investment that will bring the best short and long term returns.

Money-saving apps can not only help you become more organized when it comes to your finances but also provide you with real gains. They teach you all you need to know about al things financially sound and help you make a bit of money on the side.

They will not only help you make money but stopping you spending too much but also come with investment tips, help you manage your investments or simply invest for you.

They will not make you a rich man but they will teach you the discipline and control you need to become one.

user rating :

4.90 stars (185 votes)

Loves to play with new ideas, binge writing, traveling and gourmet coffee. Professional writer of non fiction with over 8 years experience in putting words to paper. Fan of iconic movies, sports, The Arctic Monkeys and city breaks. Yes, he knows how good his coffee is.